When you take a pill for high blood pressure, antibiotics, or diabetes, there’s a good chance it was made in China or India. These two countries produce over 80% of the world’s active pharmaceutical ingredients (APIs) and nearly 40% of all finished generic drugs sold in the U.S. But behind the low prices and high volumes lies a complex reality: manufacturing quality isn’t the same across the board. The FDA doesn’t treat them equally. And for patients, that difference matters more than most people realize.

Why the FDA Watches China More Closely

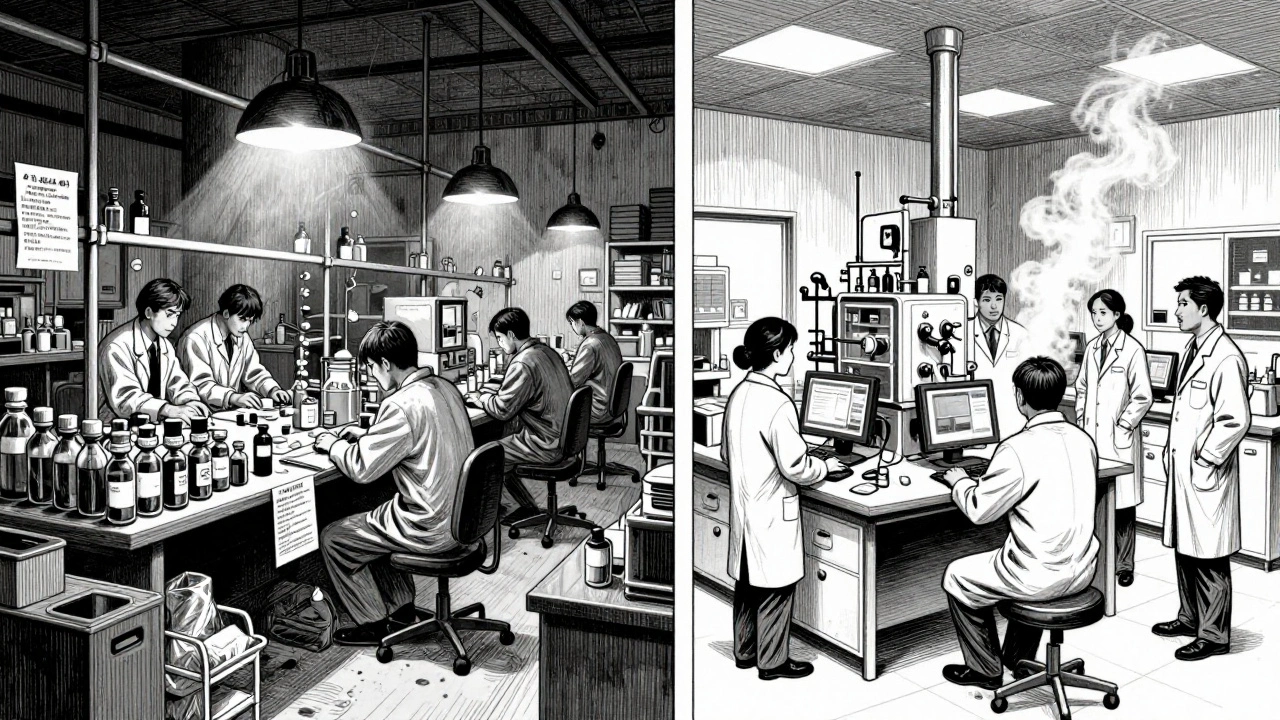

China dominates the API market. It makes the raw chemical building blocks for over 80% of the world’s generic drugs. That’s not just a big number-it’s a choke point. One factory shutdown in Shanghai can ripple through supply chains from New York to Nairobi. But scale doesn’t equal safety. Since 2018, the FDA has issued more import alerts against Chinese drug facilities than any other country. In 2023, 37% of Chinese pharmaceutical plants faced import alerts-reasons ranged from falsified test results to poor sanitation and unapproved process changes. These aren’t rare mistakes. They’re systemic. One 2022 FDA inspection report found a Chinese facility that had been producing insulin for years without proper sterilization procedures. The drug was shipped to U.S. pharmacies anyway. The problem isn’t just corruption or negligence. It’s structure. China’s pharmaceutical industry is built on a massive network of small and mid-sized factories, many of which operate with little oversight. While large state-backed companies like Sinopharm meet global standards, hundreds of smaller suppliers don’t. And because APIs are shipped in bulk, mixing high-quality and substandard batches is easy. The FDA can’t inspect every facility. So it flags the ones with the worst track records-and blocks their imports.India’s Compliance Edge

India has 100+ FDA-approved drug manufacturing plants. China has 28. That’s not a typo. India’s lead in certified facilities isn’t luck-it’s strategy. After the 1970 Patents Act allowed local production of generic drugs, India built an entire ecosystem around compliance. Companies like Dr. Reddy’s, Sun Pharma, and Cipla didn’t just learn FDA rules-they mastered them. Their labs follow 21 CFR Part 211 to the letter. Their data systems are digital. Their staff train in English-speaking regulatory environments. When the FDA sends inspectors, they know what to expect. Between 2020 and 2023, Indian facilities received 30% fewer Form 483 observations (the FDA’s official list of violations) than Chinese ones. That’s not because Indian workers are better. It’s because their systems are designed to prevent errors before they happen. Digital batch tracking. Automated documentation. Real-time environmental monitoring. These aren’t luxuries-they’re standard practice in India’s top factories. That’s why global pharma companies are shifting production to India under the "China+1" strategy. It’s not about cutting costs. It’s about cutting risk. A single FDA warning can delay a drug launch for a year. For a $500 million product, that’s a $100 million loss. India’s reliability makes it the safer bet.The Hidden Weakness in India’s Model

But here’s the catch: India doesn’t make most of its own APIs. In 2024, India imported 72% of its bulk drug ingredients from China. That means even the cleanest Indian factory might be processing raw materials from a Chinese plant with a questionable audit history. It’s like buying organic flour from a trusted bakery-but the wheat came from a field sprayed with banned pesticides. This dependency creates a single point of failure. If China restricts exports over trade tensions, or if a Chinese API plant gets shut down by the FDA, India’s drug supply chain stumbles. The U.S. government has tried to fix this. In 2023, India launched a $3 billion incentive program to boost domestic API production. But building a chemical plant takes years. And the Chinese suppliers are still cheaper. The result? India is stuck between two worlds. It’s the gold standard for finished drug manufacturing-but it still leans on China for the foundation. Until that changes, the safety of Indian-made drugs is only as strong as China’s weakest factory.

What the FDA Actually Does

The FDA doesn’t approve drugs from China or India. It approves facilities. That’s a crucial distinction. When a U.S. company wants to import a drug made in Pune or Shanghai, the FDA inspects the factory first. They check: Are the workers trained? Are the machines calibrated? Is the water clean? Are records real? If the inspection passes, the facility gets a green light. If it fails, the FDA issues a warning or blocks imports. But inspections aren’t random. The FDA uses a risk-based system. Factories with past violations get more visits. Factories with clean records get fewer. That’s why Indian facilities-despite producing more volume-get inspected less often. Their compliance history gives them trust. The FDA also tracks every shipment. If a batch of metformin from China shows signs of contamination, the FDA can flag all future shipments from that plant. They don’t need to test every pill. They test patterns. And over time, those patterns reveal which countries, and which companies, are reliable.Cost vs. Control: The Real Trade-Off

You might think: "Why not just make everything in the U.S.?" Because it’s not affordable. Making a single tablet of amoxicillin in the U.S. costs 10 times more than in India. Labor, energy, environmental regulations-it all adds up. For low-margin generics, that’s not an option. So the choice isn’t between safe and unsafe. It’s between controlled risk and uncontrolled risk. China offers lower prices but higher uncertainty. India offers higher prices but more predictability. For chronic disease drugs taken daily, predictability matters. Big U.S. pharmacies like CVS and Walgreens don’t care where the drug is made. They care if it’s on the shelf. But hospitals and insurers do. A 2023 study by the U.S. Pharmacopeia found that 68% of hospital pharmacists would switch suppliers if they learned a drug came from a facility with an FDA warning-even if the drug tested fine. That’s the real cost of cutting corners: loss of trust.

What’s Changing in 2025

India’s 2023 revision of Schedule M-its national drug manufacturing rules-is pushing factories toward EU and FDA standards. New requirements include mandatory electronic records, real-time environmental monitoring, and stricter validation of cleaning procedures. These aren’t optional upgrades. They’re mandatory. China, meanwhile, is trying to climb the value chain. It’s investing heavily in biologics, biosimilars, and gene therapies. But those are high-risk, high-cost areas. For now, it still dominates low-cost APIs. The FDA is also expanding its overseas staff. In 2024, it opened new inspection teams in Bengaluru and Shanghai. These teams don’t just check compliance-they train local regulators. The goal? Build long-term capacity, not just catch violations. The big shift? More companies are now asking: "Can we trust this supplier to stay compliant for the next 10 years?" That’s not a question you can answer with a price quote. It’s a question of culture, systems, and track record.What Patients Should Know

You can’t tell where your drug was made just by looking at the bottle. The label won’t say "Made in China" or "Made in India." But you can ask your pharmacist. And you can check the FDA’s website for import alerts on specific manufacturers. If you’re on a critical medication-like blood thinners, insulin, or seizure drugs-don’t assume all generics are the same. Some are made in factories with clean records. Others come from facilities under investigation. The FDA doesn’t ban every batch from a flagged plant. But it does flag the ones that fail. The best protection? Stick with brands you trust. If your pharmacy switches your generic to a new maker, ask why. And if you notice a change in how the drug works-side effects, effectiveness, even how it looks-tell your doctor. That’s not paranoia. That’s vigilance.Final Reality Check

China and India aren’t enemies in this story. They’re two parts of a broken system. China provides the raw materials. India turns them into medicines. The U.S. and Europe rely on both. The real problem isn’t geography. It’s lack of oversight. A drug made in India with Chinese APIs is only as safe as the weakest link. And right now, that link is still in China. The solution isn’t to stop buying from either country. It’s to demand transparency. To fund local API production. To hold every factory to the same standard-no matter where it is. Because when it comes to your health, the country on the label shouldn’t matter. What matters is whether the pill inside is safe. And right now, the FDA is the only thing standing between you and the risks you can’t see.Are drugs made in China safe to take?

Some are, some aren’t. The FDA inspects individual factories, not entire countries. Many Chinese facilities meet global standards and supply safe drugs. But a significant number have been flagged for falsified records, poor sanitation, or unapproved manufacturing changes. If a drug comes from a facility with an FDA import alert, it’s been blocked from entering the U.S. You can check the FDA’s website for current alerts on specific manufacturers.

Why does India have more FDA-approved drug plants than China?

India has focused for decades on meeting Western regulatory standards. Its top pharmaceutical companies built their business models around FDA compliance, investing in digital systems, staff training, and quality control. China, while producing more volume, historically prioritized speed and cost over transparency. Only recently has China started upgrading facilities to meet global standards, but its legacy of inconsistent inspections and smaller, unregulated factories still affects its approval rate.

Is India completely independent in pharmaceutical manufacturing?

No. India imports 72% of its active pharmaceutical ingredients (APIs) from China. That means even if a drug is packaged and finished in India, the core chemical ingredient likely came from China. This creates a supply chain vulnerability-if China restricts exports or a Chinese API plant is shut down by the FDA, India’s ability to produce drugs can be disrupted.

How does the FDA decide which factories to inspect?

The FDA uses a risk-based system. Factories with past violations, complaints, or poor inspection histories get prioritized. Facilities with clean records and strong compliance histories are inspected less often. The FDA also tracks shipment data-repeated issues with a specific manufacturer trigger more inspections. It’s not random; it’s data-driven.

Should I avoid generic drugs made in China or India?

No. Most generic drugs from both countries are safe and effective. The FDA ensures they meet the same standards as brand-name drugs. But if you’re on a critical medication, ask your pharmacist about the manufacturer. If you notice a change in how the drug works-side effects, effectiveness, or appearance-report it. Trust your experience. The FDA does too.

Jennifer Patrician

6 December 2025 - 12:41 PM

Let me guess-your blood pressure med was made in China and now you’re paranoid? Newsflash: the FDA doesn’t approve countries, they approve factories. If your pill works, stop freaking out. I’ve been on generics for 12 years and I’m still alive. You’re not saving yourself by Googling FDA alerts-you’re just feeding your anxiety.

Also, why is everyone acting like India’s a saint? They import 72% of their APIs from China. So you’re literally trusting a Chinese factory to make the stuff that goes into an Indian pill. The only difference is the label. Wake up.

And don’t even get me started on how the FDA’s ‘risk-based system’ is just corporate favoritism disguised as science. Big pharma owns the inspectors. You think they’re gonna shut down a plant that’s been churning out metformin for 20 years just because someone forgot to log a temperature? Please.

Ali Bradshaw

7 December 2025 - 17:09 PM

Interesting read. I’ve worked in pharma logistics for a decade and the real story isn’t China vs India-it’s systems vs chaos. The Indian factories I’ve seen? Spotless. Digital logs, automated humidity controls, staff in full PPE even in 40°C heat. Chinese plants? Some are clean, some look like a warehouse that got hit by a tornado and then handed a lab coat.

But here’s the kicker: the FDA doesn’t care where you’re from. They care if your batch numbers match your records. If you can prove it, you’re golden. The problem isn’t geography-it’s accountability. And India’s built that culture. China’s still playing catch-up.

an mo

8 December 2025 - 09:01 AM

Let’s cut through the woke pharma PR. China is not a ‘manufacturing partner.’ It’s a strategic vulnerability. 80% of APIs? That’s not supply chain-it’s economic warfare. The U.S. government knew this since 2010 and did nothing. Now we’re dependent on a hostile regime for life-saving drugs. This isn’t capitalism-it’s national suicide.

India’s ‘compliance edge’? It’s a temporary illusion. They’re still using Chinese precursors. So we’ve outsourced our medicine to a country that’s actively weaponizing trade. And the FDA? They’re playing whack-a-mole with inspectors while the whole house burns down.

We need domestic API production. Now. Not in 5 years. Not with ‘incentive programs.’ We need a Manhattan Project for pharmaceutical sovereignty. Or we’re all just one geopolitical hiccup away from a mass casualty event.

Jimmy Jude

8 December 2025 - 14:12 PM

What if I told you the real villain isn’t China or India… but the illusion of control?

We think we’re safe because the FDA ‘approves’ a facility. But approval is just paperwork. Reality? A factory in Shanghai can be ‘clean’ one day and ‘contaminated’ the next, and the FDA won’t know until someone in Ohio starts vomiting after taking their generic lisinopril.

And India? Oh, sweet, virtuous India-proudly importing Chinese poison like it’s organic kale. We’ve built a global medicine system on trust, not truth. We trust because it’s cheaper. We trust because we’re too lazy to demand better.

But here’s the cosmic joke: the pill doesn’t care where it’s made. It only cares if it works. And sometimes… it doesn’t. And when it doesn’t? No one takes responsibility. We just switch brands. Again.

Are we patients… or lab rats in a system designed to keep us docile and dosed?

Mark Ziegenbein

10 December 2025 - 04:29 AM

It is not merely a question of regulatory compliance or inspection frequency it is a fundamental epistemological crisis in global pharmaceutical governance the FDA operates under a paradigm of reactive risk mitigation rather than proactive systemic integrity which means that the entire architecture of drug safety is predicated on historical data not future certainty and this is profoundly dangerous because it assumes that past behavior predicts future outcomes when in fact the nature of manufacturing degradation is nonlinear and stochastic

Furthermore the notion that India is somehow ‘superior’ because it has more FDA approved facilities ignores the structural dependency on Chinese APIs which renders the entire edifice of Indian compliance a house of cards built on a foundation of foreign chemical inputs the illusion of autonomy is precisely what makes the system more fragile not less

And yes the cost differential is staggering but the true cost is not monetary it is existential the moment a batch of contaminated heparin enters the supply chain the entire trust matrix of modern medicine collapses and we are not prepared for that collapse because we have outsourced not just production but moral responsibility

Rupa DasGupta

11 December 2025 - 18:30 PM

OMG I’m Indian and I’m so embarrassed 😭

Yes we make the pills but we’re still begging China for the magic powder 🥲

My cousin works at a pharma plant in Hyderabad and they literally get shipments from China labeled ‘API-2024-BATCH-777’ with no docs. No COA. No nothing. Just a guy with a clipboard saying ‘trust us’. And we call this ‘pharmaceutical excellence’? 😅

But hey at least our packaging looks nice right? 🤡

Also why is everyone acting like the FDA is our knight in shining armor? They inspect one plant every 5 years. Five. Years. Meanwhile my grandma’s blood pressure med changed color last month. No one asked why. #IndianPharmaReality

Norene Fulwiler

13 December 2025 - 01:20 AM

I appreciate how nuanced this is. Most people just scream ‘China bad!’ or ‘India good!’ but the truth is messier-and more human.

I worked in a rural clinic in Kentucky. We had patients on insulin from a Chinese-made API, processed in India. They were doing fine. Their labs were stable. Their doctors trusted the brand.

But one day, a new generic came in-same name, same dosage, different manufacturer. One patient had a seizure. Turned out the new batch had a different excipient. Not the API. Not the active ingredient. The filler. And the FDA didn’t catch it because it wasn’t flagged.

So yeah, geography matters. But so does batch tracking. And transparency. And listening to patients when they say, ‘This doesn’t feel right.’

We need better systems. Not better countries.

Carole Nkosi

13 December 2025 - 20:16 PM

Let’s be real. This whole ‘China vs India’ narrative is just colonialism in a lab coat. We treat Chinese factories like rogue states and Indian ones like saints because of racial bias, not data. You think if a Brazilian or Nigerian plant had 37% import alerts, we’d be having this conversation? No. We’d call it ‘corruption’ and shut it down.

But China? Oh, they’re ‘strategic partners.’ India? Oh, they’re ‘democratic allies.’

The truth? The FDA is a political tool. It protects the interests of U.S. pharma giants who profit from cheap imports. It doesn’t protect you. It protects profit.

And you? You’re just a consumer. A number on a balance sheet.

Mellissa Landrum

14 December 2025 - 06:31 AM

the fda is a joke. they inspect a plant once every 7 years and then act like they saved your life. meanwhile my neighbor’s kid had a seizure after switching to a generic made in china. the label said ‘made in india’ because the company just slapped a new sticker on it. who’s checking? no one.

and dont even get me started on how the usa buys 80% of its meds from china but calls them ‘foreign threats’ when they try to make vaccines. hypocrisy much?

also why is everyone pretending india is clean? their water is dirty their workers are overworked and they still import 70% of their chems from china. its all smoke and mirrors. the real danger? you dont even know what you’re taking.

Manish Shankar

14 December 2025 - 17:08 PM

Respectfully, the narrative of India as a regulatory exemplar requires contextual refinement. While it is true that Indian manufacturers have invested significantly in Good Manufacturing Practices (GMP), the infrastructure of API sourcing remains fundamentally vulnerable. The 72% import dependency on China is not merely an economic choice-it is a structural vulnerability embedded in the global division of labor. The Indian pharmaceutical industry, while operationally sophisticated, remains chemically dependent. This is not a failure of compliance, but a failure of industrial policy.

Furthermore, the FDA’s risk-based inspection model, while data-driven, is inherently reactive. It responds to historical deviations rather than anticipating systemic risk. Until India achieves vertical integration in API production, its regulatory superiority remains contingent upon the integrity of external supply chains-supply chains that are neither regulated nor monitored by Indian authorities.

Therefore, the solution lies not in nationalistic comparisons, but in global harmonization of API standards, investment in indigenous manufacturing, and the establishment of multilateral oversight mechanisms that transcend geopolitical boundaries.

luke newton

15 December 2025 - 12:40 PM

Everyone’s so busy blaming China and patting India on the back they’re missing the real villain: the American consumer who wants $4 prescriptions and doesn’t care how it’s made.

Here’s the truth: you don’t get to demand cheap medicine and then act shocked when it’s made in a factory where the water’s brown and the workers are paid $2 a day.

And don’t give me that ‘FDA inspects’ crap. They inspect one plant in China every 5 years. Five. Years. Meanwhile, your neighbor’s grandma is taking the same pill you are-and she’s the one who ends up in the ER because the batch had a bad excipient.

Stop pretending this is about safety. It’s about greed. And you’re part of it.

Lynette Myles

17 December 2025 - 05:55 AM

China has 28 approved plants. India has 100+. But 72% of India’s APIs come from China. So the real number is: 0 safe, independent supply chains. The FDA’s system is a house of cards. And we’re all just waiting for the wind to blow.

Annie Grajewski

18 December 2025 - 12:58 PM

oh wow so india is the good guy now? lmao they import 72% of their stuff from china like its a grocery run 🤡

and the fda? they inspect like once every 5 years and then act like they’re the guardians of your life. bro the plant that made your metformin might have a sign that says ‘no smoking’ but the guy who signed off on the batch was asleep at 3am.

also why is everyone acting like this is news? i’ve been on generics since 2015 and i’ve had 3 different pills that looked nothing alike. same name. same dose. totally different results. but hey at least its cheap right? 😘

Marvin Gordon

18 December 2025 - 23:39 PM

I’ve worked in global supply chains for 15 years. This isn’t a China vs India story. It’s a ‘we built a global system without accountability’ story.

China makes the base chemicals. India makes the pills. The U.S. buys them. Europe buys them. Africa buys them. But no one owns the whole chain. No one’s responsible for the whole thing.

The FDA does inspections. But inspections are snapshots. They don’t capture culture. They don’t capture training. They don’t capture what happens when a supervisor is pressured to cut corners to meet a deadline.

The real solution? Not nationalism. Not blame. Not ‘China bad.’

It’s traceability. Every batch, from raw chemical to pill bottle, needs a blockchain-style digital trail. Not just for regulators-for patients.

Imagine scanning a QR code on your pill bottle and seeing: ‘API sourced from Facility X in Shanghai, inspected 03/2024, certified clean. Finished in Pune, batch #1123, inspected 04/2024.’

That’s transparency. That’s trust.

Until then, we’re all just guessing.

ashlie perry

19 December 2025 - 16:12 PM

china bad india good fda watching them all like a hawk yeah right

my blood pressure med changed from blue to yellow last month and no one said a word. guess what? it was made in the same place. just a new batch. same factory. same country. but now its ‘safe’ because the label says ‘made in india’

we dont know what were taking. and we dont want to know. its easier to just swallow it