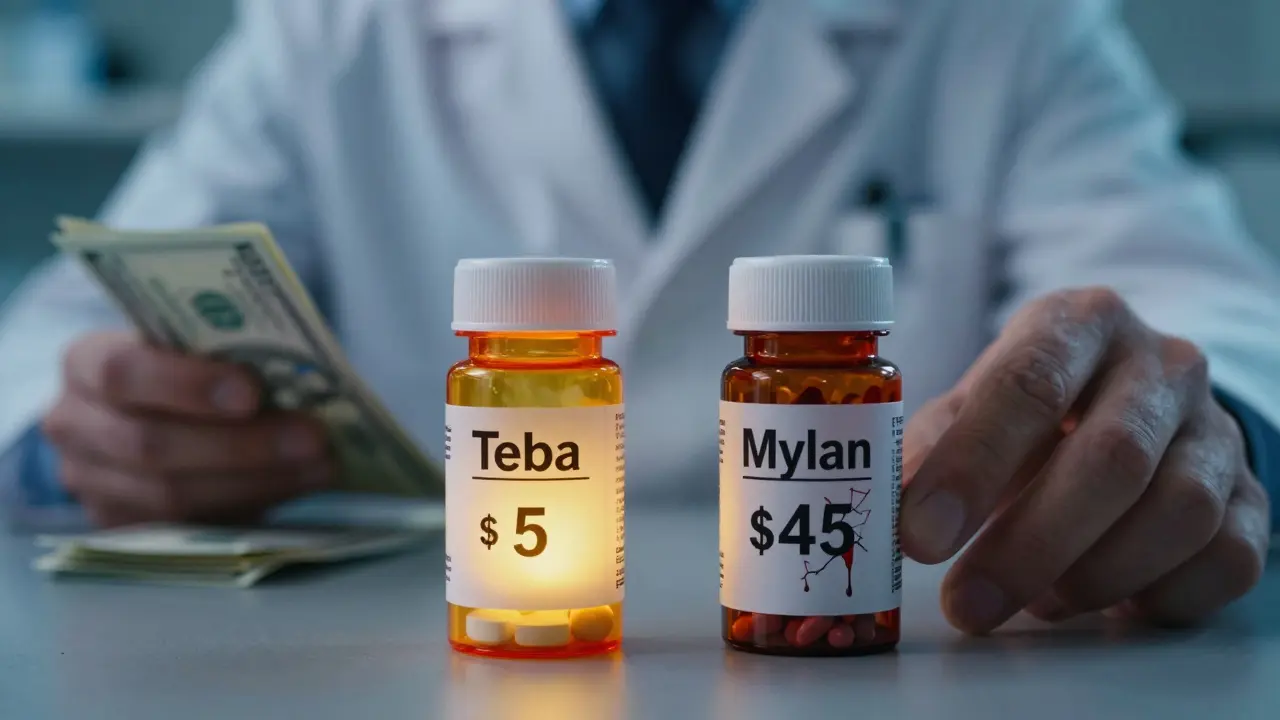

Have you ever picked up a generic prescription and been shocked at the price? You thought generics were supposed to be cheaper - but your $5 pill suddenly costs $45. What’s going on? It’s not a mistake. It’s not fraud. It’s tiered copays - a system designed to control drug spending, but one that often leaves patients confused, frustrated, and out of pocket.

How Tiered Copays Work

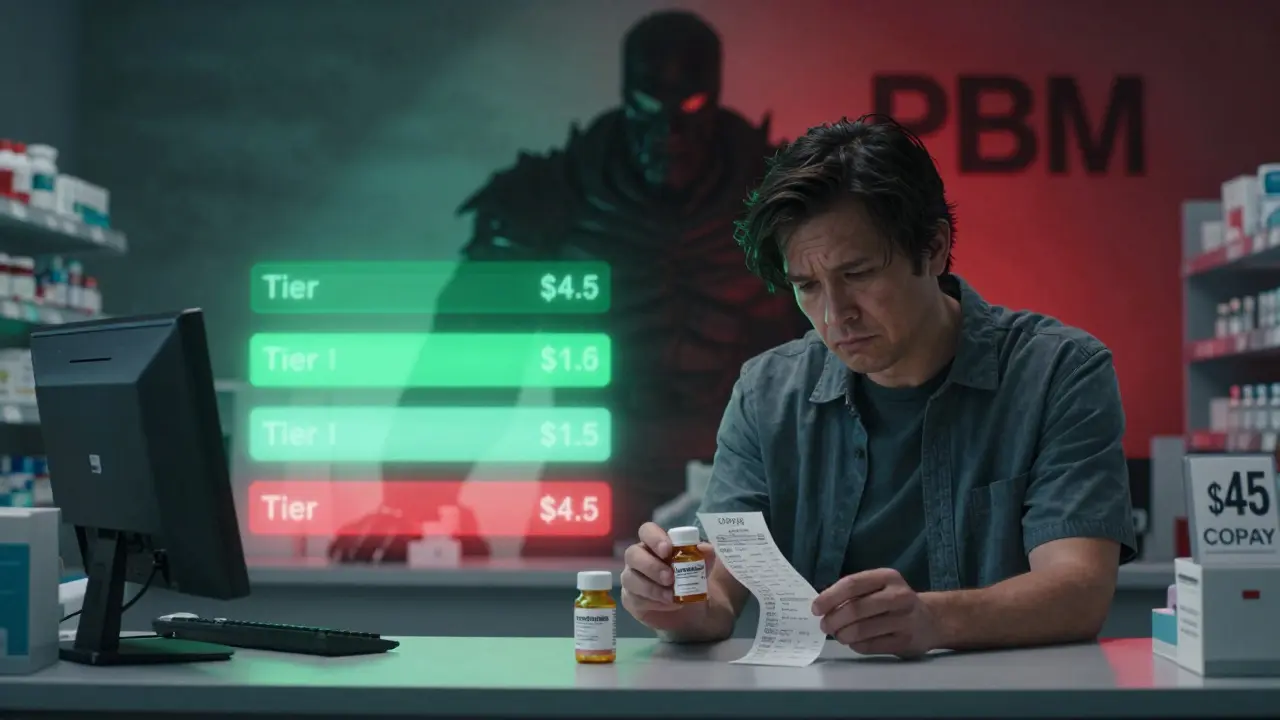

Most health plans don’t charge the same amount for every drug. Instead, they sort medications into tiers - like levels in a video game - and each level has its own price tag. Tier 1 is usually the cheapest. Tier 5 is the most expensive. The idea is simple: encourage you to pick drugs that cost the plan less, and you’ll pay less too. But here’s the twist: not all generics are in Tier 1. In fact, about 12% to 18% of generic drugs are placed in Tier 4 or 5, even though they’re chemically identical to cheaper versions. Why? Because the drugmaker didn’t pay enough to the Pharmacy Benefit Manager (PBM) to get preferred status. PBMs - companies like CVS Caremark, Express Scripts, and OptumRx - are the middlemen between insurers and drugmakers. They negotiate discounts and rebates. The more money a drugmaker gives them, the better placement their drug gets. It’s not about effectiveness. It’s not about safety. It’s about who paid the most.Why Your Generic Is in Tier 2 (Or Higher)

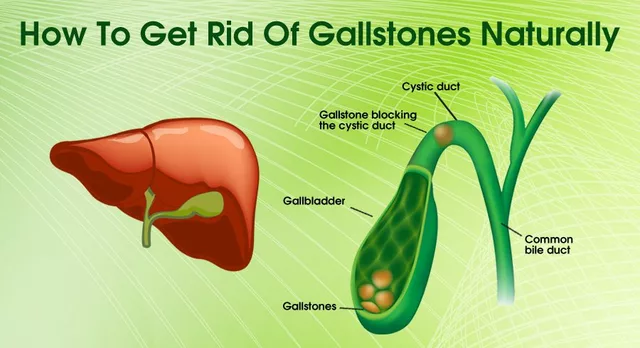

Let’s say you take levothyroxine, a common thyroid medication. There are dozens of generic versions made by different companies. Your plan might list one brand - say, Teva - as Tier 1 with a $5 copay. Another version - say, Mylan - is Tier 3 with a $45 copay. Both contain the exact same active ingredient. Both work the same way. But one is cheaper for your plan because Teva gave the PBM a bigger rebate. This isn’t rare. In 2024, Express Scripts moved 87 generic drugs to higher tiers after their rebate deals expired. UnitedHealthcare shifted some high-volume generics like atorvastatin to $0 copays, but moved less common ones to $10. That means your doctor prescribes the same drug, but depending on which pharmacy fills it - or which generic is available - your out-of-pocket cost can jump by hundreds of dollars a month. The same thing happens with specialty generics. Drugs like adalimumab (a biosimilar for rheumatoid arthritis) are technically generic versions of biologics. But because they cost $5,000 to $10,000 per month, they’re often placed in Tier 4 or 5. Even if you’re on a generic, you might pay 30% coinsurance - meaning you fork over $1,500 to $3,000 per month.Generics Aren’t Always the Cheapest Option

You might assume that if a drug is generic, it’s automatically the cheapest choice. That’s not true. Some brand-name drugs are in lower tiers than their generic counterparts. Why? Because the brand-name drug has a better rebate deal. For example, a brand-name blood pressure pill might be in Tier 2 with a $30 copay. A generic version of the same drug might be in Tier 3 with a $60 copay. The brand is cheaper to you - even though it’s more expensive to the system overall. This is counterintuitive, but it’s standard practice. PBMs want to steer patients toward drugs that give them the biggest cut, not the ones that are clinically superior. A 2023 Patient Advocate Foundation survey found that 41% of insured adults had experienced a generic drug with a higher copay than expected. And 68% said they couldn’t get a clear explanation from their insurer.

What You Can Do

You don’t have to accept this. There are ways to fight back.- Check your formulary - every plan updates its drug list once a year, usually in October. Log into your insurer’s website or call them. Ask for the current tier list. Look up your drug by name, not just by category.

- Ask your pharmacist - pharmacists often know which generic versions are cheaper. If you’re handed a pill with a high copay, ask: "Is there another version of this drug that’s in a lower tier?" They can sometimes switch it without a new prescription.

- Request a therapeutic interchange - this is a formal request from your doctor to switch you to a preferred drug. Your doctor fills out a form, and your insurer approves it 63% of the time. It’s not a guarantee, but it’s worth trying.

- Use cost tools - apps like GoodRx and SmithRx show you real-time prices at nearby pharmacies. Sometimes, paying cash is cheaper than using insurance.

- Look into manufacturer assistance - many drugmakers offer coupons or patient assistance programs. In 2023, these covered 22% of specialty drug costs for eligible patients.

Why This System Persists

You might wonder: why hasn’t this been fixed? The answer is money. Tiered copays save insurers billions. According to a 2005 study, adding a third tier for non-preferred brands cut demand for those drugs by over 15%. That means fewer claims, lower overall spending. But there’s a cost - to patients. A 2005 study found that when diabetes drugs moved from Tier 2 to Tier 3, adherence dropped by 7.3%. People skipped doses because they couldn’t afford them. That leads to hospital visits, emergency care, and higher long-term costs. The system works for PBMs and insurers. It doesn’t always work for you.

What’s Changing in 2025 and Beyond

Starting in 2025, Medicare Part D will cap out-of-pocket drug costs at $2,000 per year. That’s a big deal. It won’t eliminate tiered copays, but it will limit how much you pay - no matter how high the tier. Some lawmakers are pushing bills to ban tiering of generics altogether. The bipartisan Prescription Drug Pricing Reduction Act would require all generics of the same drug to be in the same tier. That would end the practice of charging more for chemically identical pills. But for now, the system stays. And if you’re paying more for a generic than you expected, it’s not you - it’s the contract between the drugmaker and the PBM.Bottom Line

Your generic drug isn’t expensive because it’s inferior. It’s expensive because someone else got paid to make it that way. The system is designed to save money - but not always for you. The key is to know your plan, ask questions, and don’t assume anything. Just because a drug is generic doesn’t mean it’s cheap. And just because it’s cheaper doesn’t mean it’s better. Stay informed. Stay proactive. And if your copay jumps for no clinical reason - push back. You have more power than you think.Why is my generic drug in a higher tier than the brand-name version?

It’s not about effectiveness - it’s about rebates. The brand-name drug’s manufacturer may have paid the Pharmacy Benefit Manager (PBM) a larger discount than the generic maker did. Even though the generic is chemically identical, the PBM puts it in a higher tier to push patients toward the drug that gives them the biggest cut. This is common and legal.

Can I switch to a cheaper generic without changing my prescription?

Yes - but only if your pharmacist is allowed to substitute. Many states allow pharmacists to swap one generic for another unless your doctor writes "dispense as written." Even if they can’t switch automatically, you can ask. Pharmacists often know which versions are in lower tiers and can suggest alternatives. Always check the price at the counter before you pay.

Do all insurance plans use tiered copays?

Almost all of them do. As of 2023, 98% of employer-sponsored plans and 99% of Medicare Part D plans use tiered formularies. Most have 4 to 5 tiers, with generics usually in Tier 1 - but not always. Some plans even have a Tier 2 for "non-preferred generics," which cost more than preferred ones, even though they’re the same drug.

What’s the difference between a generic and a biosimilar?

A generic is a chemically identical copy of a brand-name drug, usually taken as a pill. A biosimilar is a copy of a complex biologic drug - like those used for arthritis or cancer - made from living cells. Biosimilars aren’t exact copies, so they’re treated differently by insurers. Many are placed in high tiers (Tier 4 or 5) and require coinsurance instead of a flat copay, even if they’re cheaper than the original.

Can I appeal if my drug is moved to a higher tier?

Yes. If your drug suddenly jumps to a higher tier mid-year, you can file an exception request. You’ll need a letter from your doctor explaining why the change affects your health. Many plans approve these requests, especially if the new tiered version causes side effects or isn’t as effective. Medicare and commercial plans typically allow 72 hours for urgent appeals.

Are there tools to compare drug tiers across plans?

Yes. Tools like GoodRx, SmithRx, and your insurer’s own formulary lookup can show you how different plans price the same drug. Medicare’s Plan Finder tool lets you compare Part D plans by cost for your specific medications. Some third-party apps even show which pharmacy has the lowest cash price - sometimes lower than your insurance copay.

Lyle Whyatt

7 February 2026 - 20:26 PM

Okay, I just spent 45 minutes on my insurer’s website trying to figure out why my levothyroxine went from $5 to $42. Turns out, the ‘preferred’ version is made by a company I’ve never heard of, and the one my doctor prescribed got demoted because the PBM didn’t get enough kickback. I’m not mad-I’m just confused. How is this even legal? I’m not asking for free medicine. I’m asking for consistency. Two pills with the same chemical formula, same dosage, same manufacturer (same factory, same batch code), and one costs 9x more because someone in a suit negotiated a better deal with a middleman who doesn’t even touch the product. This isn’t healthcare. It’s a rigged casino.

And don’t get me started on how pharmacists are stuck in the middle. I asked mine last week if there was a cheaper generic. She sighed, said ‘I wish I could swap it, but the system won’t let me unless your doctor rewrites the script,’ and then quietly slipped me a GoodRx coupon. That’s the real hero here-not the insurer, not the PBM. The pharmacist who risks her job to help you out.

Also, side note: I checked my 2025 plan. They moved my asthma inhaler to Tier 5. I’m 32. I don’t have a trust fund. I’m just trying to breathe.

TL;DR: We’re being played. And the people who actually care? They’re the ones at the counter, quietly breaking the rules to help us survive.

Random Guy

8 February 2026 - 10:02 AM

so like… my ‘generic’ vyvanse costs more than the brand? 😭

turns out the brand has a better rebate deal??

so i’m paying 70 bucks for the ‘real’ thing and 85 for the ‘copy’??

who wrote this system? a villain from a disney movie??

Brett Pouser

8 February 2026 - 12:56 PM

As someone who’s been on insulin for 15 years, I’ve seen this play out in real time. Back in 2018, my copay jumped from $10 to $110 because my plan switched to a different biosimilar. I had to choose between paying for my meds or paying rent. I chose rent. Two months later, I ended up in the ER. That’s not a coincidence.

What’s wild is that the same drug, same company, same packaging, same lot number, got moved to a higher tier just because the rebate deal expired. No one told me. No one asked me. I just got a bill that broke me.

I’m not angry anymore. I’m just tired. And I know I’m not alone. If you’re reading this and you’re struggling-reach out. There are people who can help. You don’t have to suffer in silence.

Joshua Smith

10 February 2026 - 04:24 AM

Just wanted to say I checked my formulary today after reading this. My blood pressure med went from Tier 1 to Tier 3. I called my pharmacist and they had a version in Tier 1 I didn’t even know existed. Switched it over-copay dropped from $62 to $12. It took 12 minutes.

Point is: you don’t have to accept this. Just ask. Ask your doctor. Ask your pharmacist. Ask your insurer. They don’t always tell you this stuff, but it’s there. And yeah, it’s a pain, but it’s worth the hassle. I’ve been paying $12 for 6 months now. I’m not rich, but I’m not bankrupt either.

Jessica Klaar

10 February 2026 - 14:45 PM

I work in a clinic. I see this every single day. Patients crying because they can’t afford their meds. Some of them skip doses. Some of them split pills. Some of them just stop. And then they come back in six months with a heart attack or a stroke.

This isn’t about ‘personal responsibility.’ This is about a system that rewards greed over health. I’ve had patients tell me they’re choosing between insulin and their kid’s school supplies. I’ve had one tell me she’s using her late mother’s leftover pills because she can’t afford a refill.

We talk about ‘health equity’ like it’s a buzzword. But when someone’s life is on the line, it’s not a slogan. It’s a crisis.

If you’re reading this and you’re lucky enough to have stable access-don’t just scroll. Speak up. Vote. Tell your reps. This isn’t political. It’s human.

PAUL MCQUEEN

11 February 2026 - 16:43 PM

you know what’s funny? people act like this is some new scam. nah. it’s been like this since the 90s. you think PBMs are new? they’ve been gaming the system since before smartphones.

and now everyone’s shocked? lol. if you didn’t know this was happening, you weren’t paying attention.

also-why are you surprised that companies do what’s profitable? you think they’re here to help you? they’re here to make money. the system works exactly as designed. you just didn’t read the fine print.

and now you want a handout? sorry. that’s not how capitalism works. maybe don’t take 5 pills a day if you can’t afford them.

John Watts

12 February 2026 - 17:33 PM

Let me tell you something real quick: I used to work for a PBM. Not a high-up, not a CEO-just a data analyst. I saw the spreadsheets. I saw the rebates. I saw how drugs got moved based on who paid the most. I quit because I couldn’t sleep at night.

Here’s the thing no one says: this isn’t even about the money. It’s about control. The PBM doesn’t care if you’re healthy. They care if you’re compliant with their preferred drug. If you take the ‘right’ pill, they get a cut. If you don’t? They don’t care if you end up in the hospital. They’ll just bill your insurer more.

And here’s the kicker: most doctors don’t even know this. They think they’re prescribing based on clinical need. They’re not. They’re prescribing based on what’s on the formulary. And the formulary? It’s not medical. It’s financial.

If you want change? Don’t just ask your pharmacist. Ask your doctor: ‘Which version of this drug gives the PBM the biggest rebate?’ That’s the question they’re not trained to answer. But it’s the one that matters.

Chima Ifeanyi

14 February 2026 - 11:16 AM

Let’s deconstruct this systemic pathology. The tiered copay architecture is a classic rent-seeking mechanism, wherein PBMs extract surplus value from the pharmaceutical value chain via asymmetric information asymmetry. The regulatory capture is evident: CMS has no authority to audit rebate structures, and the 340B program is neutered by contractual carve-outs.

Moreover, the economic inefficiency is compounded by the fact that formulary placement incentivizes therapeutic inertia, thereby increasing downstream utilization of acute care services-effectively externalizing costs onto public payers. The net present value of avoidable hospitalizations due to non-adherence exceeds $120B annually in the U.S. alone.

What’s needed is not anecdotal solutions like GoodRx, but structural reform: mandatory transparency in rebate disclosures, prohibition of tiering for therapeutically equivalent generics, and the elimination of PBM ownership of pharmacies to prevent vertical integration conflicts.

Until then, we’re just rearranging deck chairs on the Titanic while the patient drowns.

Elan Ricarte

15 February 2026 - 18:46 PM

so let me get this straight-my body is a piggy bank and the PBM is the guy who cracks it open with a crowbar while the drugmaker hands him a gold-plated handshake?

and the doctor? the doctor’s just the guy who signs the permission slip saying ‘yeah, i guess this is fine.’

and the pharmacist? she’s the one who whispers ‘hey, try this one-it’s cheaper’ while the system screams ‘NOOOO YOU CAN’T DO THAT’

we’re not patients. we’re ATM cards with a pulse.

and the worst part? i’m supposed to be GRATEFUL because i’m not paying $10,000 a month.

fuck this. i’m switching to hemp oil and duct tape.

Angie Datuin

17 February 2026 - 17:40 PM

I’ve been on a generic for anxiety for years. Last month, my copay went from $10 to $58. I didn’t say anything. I just started skipping doses. I didn’t want to deal with the call centers or the paperwork. I just… stopped.

It’s been two weeks. I feel worse. But I’m not alone. I’ve seen others do it too. We don’t talk about it. We just nod at each other in the pharmacy line.

This isn’t about policy. It’s about silence. And that’s what they count on.

Camille Hall

17 February 2026 - 21:55 PM

My mom’s on 7 medications. Every time one changes tier, she spends hours on the phone, filling out forms, getting letters from her doctor. She’s 71. She doesn’t have a computer. She uses a landline.

I helped her last month. We spent three days on it. They finally approved the switch-after she had gone without for two weeks.

She didn’t complain. She just said, ‘I’m lucky I have someone to help me.’

That’s the real tragedy. People like her shouldn’t need a child to fight for their medicine. They should just be able to walk in and get it.

I wish I could fix it. But for now, I’m just here to remind you-your mom, your dad, your neighbor-they’re all just trying to stay alive. And they’re tired.

Ritteka Goyal

19 February 2026 - 13:46 PM

you know what i love? how americans act like this is some kind of conspiracy. in india, we have generics for 10 rupees. 10 rupees! and we don’t have PBMs or tiered systems. why? because we don’t let corporations turn medicine into a game of monopoly.

in the u.s., you need a phd to figure out why your pill costs 50 bucks. in india, you walk into a pharmacy, say the name, pay 10 bucks, and leave.

and yes, we have quality issues too. but at least we don’t have people choosing between insulin and rent.

you think this is capitalism? no. this is greed with a medical license.

and if you’re still defending this system, you’ve forgotten what ‘healthcare’ even means.